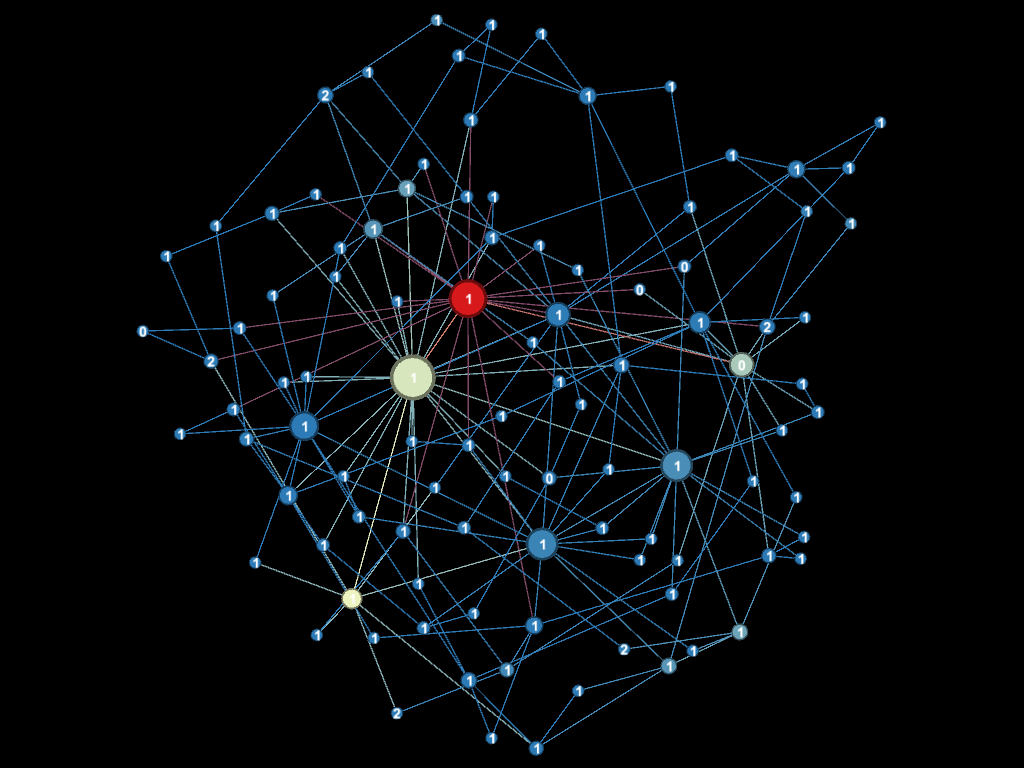

Transitive transaction describes the process whereby two untrusted (unconnected) agents on a network can transact (exchange coins) using their common, mutually trusted connections acting as intermediaries.

The following provides a description of the transitive transaction algorithm Polis uses in our network-based economic modeling (supporting definitions are provided further down).

A Buyer agent (B) and a Seller agent (S) are two agents that exist on the same network. They do not have to be neighbors. B wants to buy something from S for a transaction amount (price) P.

Step 1: Find all paths through the network between B and S using the network's Adjacency Matrix as follows:

- Record each of B’s neighbors (connections) as a path

- Recursively search each of B’s neighbors uncommon neighbors (connections) until

a. S is found (a success), or

b. The recursion exceeds a step limit without finding S (a failure), or

c. The path loops back to B before finding S (a failure) - Record all paths found to S

- Sort them from shortest to longest

Step 2: Determine if there is enough liquidity on each path to support the deal

- Loop over each path (sorted shortest to longest)

a. Loop over each segment on the path

b. For each segment determine if there is enough liquidity between the connected agents to support the deal - Stop when the first path is found that is liquid across the entire path

Step 3: If a liquid path is found, record the transaction (writing appropriate transaction records in the ledgers of each agent along the path, including B and S) or record a transaction failure due to insufficient liquidity.

Supporting Definitions

-

Every agent has their own, personal currency. All currencies have the same transfer price, currently zero (not to be confused with the transaction price).

-

An agent A will accept the following types of currency from agent B if A and B are mutually trusted neighbors (connected). A will accept

- B’s currency

- Any of A’s currency B might possess

- Any currency B has from other agents that both A and B trust (are directly connected, named mutually connected agents).

-

Deal liquidity means agent B possesses a basket of currency types that agent A will accept in sufficient quantity to meet or exceed the transaction amount (price).

-

The order for which a bag of currency equalling the transaction amount is passed from B to A is

- If B holds A’s coins, these will be transferred first

- Next, if necessary, coins from mutually connected neighbors will be transferred

- Finally, if necessary, B’s coins will be transferred to A

-

In the case above with B and S transacting, and B and S not being neighbors (being unconnected), these measures of liquidity and rules of coin transfer hold for all agents situated on each segment of the path between B and S. In this case B and S will transact but not not share coins directly, instead a chaining process is performed using the agents along the selected network path that lies between them as intermediaries.

Notes

-

It is by convention only that we use the shortest available liquid path.

-

Similarly, by convension, we use the first liquid path discovered from an ordered list regardless if there are one or more paths of the same length.

-

Similarly, by convension, we adopt the order of coin types transferred from B to A to meet the transaction price.

-

A curious consequence of this apparatus is ones “current balance” is relative, one may have as many “current” balances as one has neighbors.